When a new tradeline is reported to the credit bureaus for a replacement card, the account open date should be the same on the “new” account as it was on the original card. But if a brand new tradeline is added to your reports and the original tradeline is closed as a lost/stolen card, that could be a different story. If your reissued card is reported to the credit reporting agencies as the same original tradeline (just with an updated number), your credit score shouldn’t change. When a reissued card could affect your credit report All other information remains the same on your report.

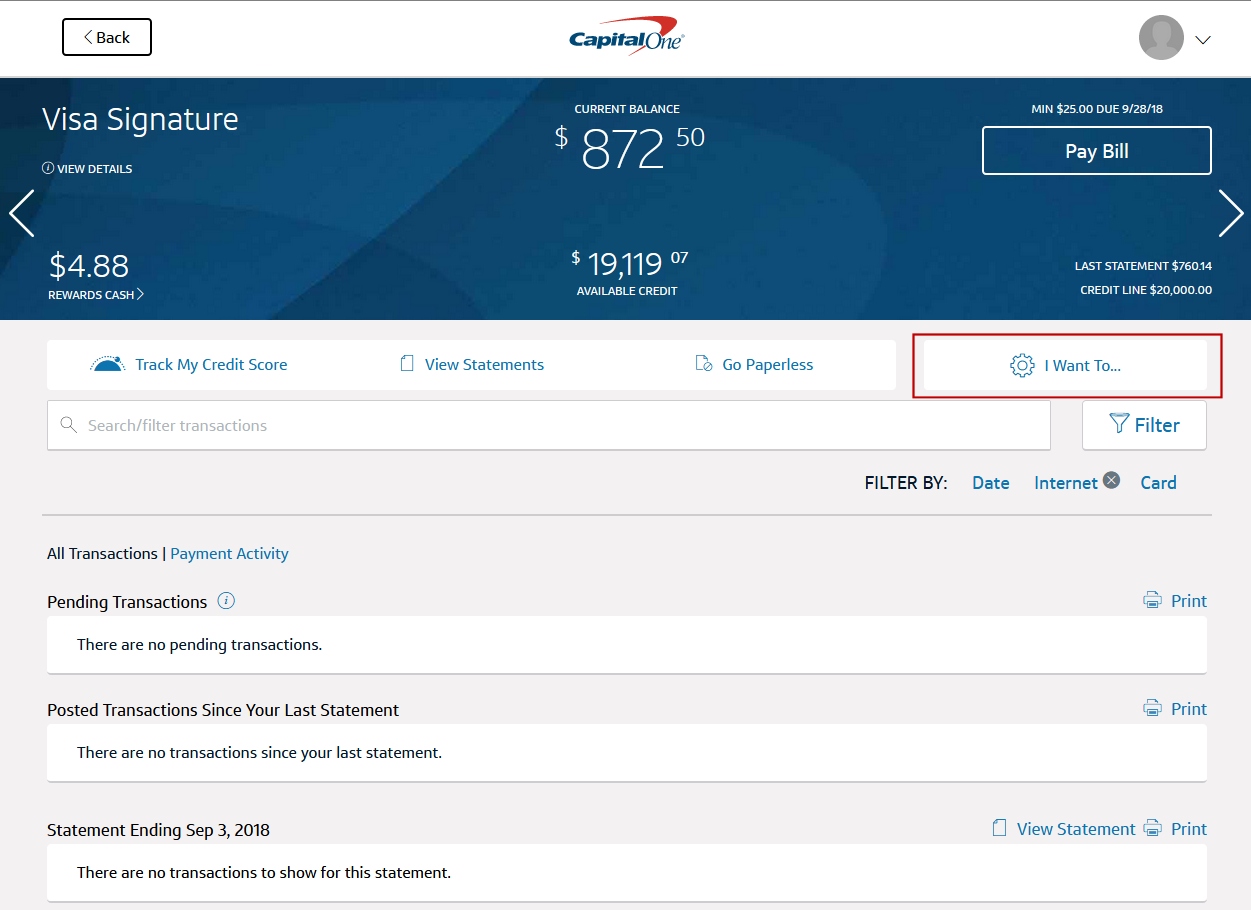

Capital one credit card lost update#

It may update your tradeline to reflect the new account number it issues you on your replacement card.It may report your old credit card as a closed account (lost/stolen) and report a “new” account (aka tradeline) to the credit bureaus with your new card number.The next time your card issuer updates your information with the credit bureaus, it may choose to report the change in one of two ways: What Happens After I Report My Lost Card?Īfter you report your card as lost or stolen, your issuer will cancel the card and then mail you a new one with a new account number. You may also want to freeze your credit reports and create a fraud alert as a precaution. However, if your wallet is stolen and your Social Security card was inside (not something we recommend), report the fraudulent use to the credit reporting agencies. Payment processor contact information Payment ProcessorĪ stolen credit card doesn’t automatically lead to identity theft. Credit card issuer contact information Credit Card Issuerīank of America Lost/Stolen Card Reporting The cheat sheet contains the phone numbers you need to report your card as lost and the individual lost/stolen card reporting websites as well. Since your card is gone, here is a collection of popular card issuers and networks. You may also need to follow up with a certified letter, especially if you need to dispute a charge. You can call the number on the back of your card to contact your issuer. It’s best to report a lost credit card as soon as you notice it’s missing, though some credit card issuers are more forgiving than others. If you think your card has been stolen and used for fraudulent purchases, you may need to dispute the charges with your card issuer as well. The first thing you should do when your credit card goes missing is report the lost card to your card issuer. There are some simple steps you can take to remedy the problem.

So, if you’ve just realized that your credit card is lost or stolen, don’t panic. Plus, the major credit card networks all have $0 fraud liability policies, meaning that you won’t have to pay for unauthorized charges as long as you report the problem right away. If your credit card is used without your permission, your liability for fraudulent charges is limited by law. But as long as you notice the lost card and act quickly, this situation should be no cause for alarm. And don’t forget to make sure no one is eavesdropping.A stolen credit card may sound like a nightmare.

Be careful not to write your account number down on paper or anywhere someone might find it. Identity thieves don't always need your credit card to commit identity fraud. Look for charges you don’t think you made. Check your credit card statements as soon as they arrive.That way, you’ll be ready to report a lost or stolen credit card when you need to. Consider including account numbers, expiration dates, and telephone numbers for each issuer. Keep a record of your credit card information in a safe location.Keep track of your cards and store ones you don’t use in a secure place.Make sure you cut through the account number. Cut up old credit cards before you throw them away.Don’t break with routine and, say, slip your card in a breast pocket or top of your sock. Keep your credit card securely in your wallet or purse.Here are some suggestions, along with a few tips to consider just in case you do lose a card:

0 kommentar(er)

0 kommentar(er)